Katie

Imagine being Katie, a twenty-something year-old married woman with a toddler. She and her husband have full time occupations that financially bring them a little over the poverty line, which is about $20,000 for her size of family. Before the Affordable Care Act was enacted in 2010, Katie paid $95 each month for insurance for her family. After “Obamacare”, the nickname for the ACA, became law, those premiums reached a drastic high of $350 per month. Even before her insurance reached this height, the couple struggled to pay bills and provide for their small family. With the individual mandate commencing in in January 2014, which enforces all individuals to either purchase health care or pay a penalty, Katie’s family’s finances will worsen or possibly improve(Walsh).

Before you allow your emotions to take hold of you and begin name calling as many do when they hear a political, yet personal story like this, please read on. Many factors play a role in this political issue of why the individual mandate exists. These factors include high costs within the healthcare system today, what creates those costs, and how those costs affect individuals. One person cannot be blamed for the high costs within the healthcare system.. In order to find where such blame goes, the costs and what causes costs should be studied critically to have a complete view of the picture. Once studied, we can move on to how the individual mandate might affect the country’s current health care system. In this report, each of the complicated factors mentioned will be discussed in order to find out how the individual mandate will help improve or complicate the costs of healthcare.

The Current Cost of Healthcare

Before the problems mentioned above are discussed, the current cost of healthcare must be known. Compared with the other expenses our country pays for every year, healthcare costs have reached the highest. In addition to this, the cost grows consistently each year. As it escalates, it creates numerous difficulties. For example, families and individuals cannot afford health insurance, businesses have to continually revise what they offer to their employees; and taxes must increase in order to pay for the government programs, Medicaid and Medicare, or else capability to join the federal programs declines dramatically(Kaiser).

In 1970, 7.2% of the Gross Domestic Product went towards health care. By 2011, that percentage had risen to the height of 17.9%. Though the percentage has been rising consistently, in 2002 it slowed down due to the recession. These costs are projected to rise per person from $8,300 to $13,000 between now and 2017(CBO).

Although the financial measures put towards health care amount to high costs, only a small portion of the population take part in these costs. Almost 50% of the money spent on health care in 2009 paid for only 5% of the population and 21.8% of the money treated the 1% of the population whose expenditures were above $51,951(Kaiser).

Looking even deeper into the cost of healthcare, the differences between gender and age groups can be seen. When it comes to health care spending, those 65 and above spend on average the most at about $10,000. Compared with each other, children and young adults have a similar pattern of spending, averaging $1,750. In addition to this, women are more likely to spend more money on healthcare than men($4,635 vs. $3,559). (Kaiser)

What Makes the Costs So High

Although only a brief overview of the costs of healthcare have been given, what makes these costs so lofty can now be discussed. Costs increase for multiple reasons, including technological advances, wasteful spending, aging population, and unhealthy lifestyles. In order to provide a simple view of these influences, two diverse ones will be discussed: technology and waste.

The pursuit of new technology accounts for half of the current health care costs. As more unique and chronic diseases present themselves, more technological advances are pursued in order to find treatments for them. These illnesses are especially common among the elderly. Since many of these are unique, the same treatment cannot usually be used over and over again. In addition, since various illnesses are chronic, like diabetes or Alzheimer's, these treatments must last a lengthy amount of time to provide adequate results for the individual. This technology, then, is benefiting individuals but also costing the country millions of dollars. The Kaiser Family Foundation sums up this problem well: “A small share of the population accounts for a high proportion of costs”( Kaiser).

Wasteful spending accounts for one third to almost one half of the costs spent on health care. One study projected the waste to be $476 billion to $992 billion of the total spending on health care in 2011(Health Affairs). When calculated as a percentage, this adds up to 18% to 37% of the approximately $2.6 trillion amount of costs. Waste can occur in five different spheres of the health system: patients can be cared for in a way that leaves them with more harm than they had at first; patients might receive care which interrupts or complicates their admission to or discharge from the hospital; patients can overtreated by defensive medicine, which intended to be helpful is actually unnecessary or unsuitable; administration in hospitals, insurance agencies, and the government are inefficient and time consuming; and a service expected to cost a specific price actually winds up being more costly(Aetna).

How Costs Affect Americans

The rising healthcare costs affect the country as a whole and when dissected, these costs also affect two specific groups as well: families and businesses, the makeup of this country. As costs continue to rise, families must make difficult choices, such as cutting back on protective health care. In a survey, families answered that in certain circumstances they relied on home treatments instead of going to the doctor, skipped an important medical test, or did not fill a prescription that was needed(Kaiser). Any current monthly cost a family could actually afford simply does not provide the necessary coverage the family needs. In 1965 Medicaid stepped in to help children and disabled individuals who financially could not afford health care. On average, a family must be 250% below the poverty level to qualify for Medicaid. Because health care costs are rising much faster than the federal poverty level, many people with low incomes are still not eligible for government or state coverage. However, since their income is low, they still cannot afford to pay for the high premiums of current insurance. This problem within healthcare greatly affects families.

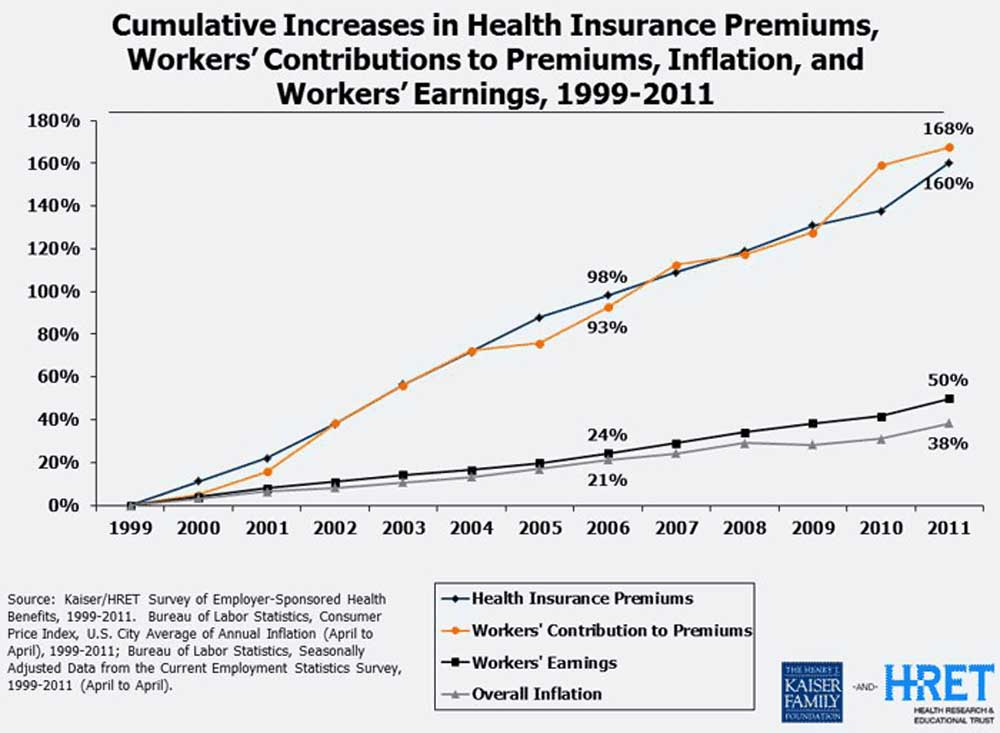

In addition to families being affected by high costs in the healthcare system, businesses are also affected. Employers and employees are both included in this issue. Premiums usually rise between 3 to 13% each year while wages and inflation only rise about 2% to 4% each year(Kaiser). Because premiums rise faster than wages and inflation, action must be taken within businesses. To combat the rising premiums while retaining coverage, a few things can happen. Employers or businesses can lower wages or hours, or simply not allow employees to have raises. The other option is that employees must contribute more from their wages for their insurance or their health benefits could be reduced within the coverage. In both cases, employers and employees are seriously affected by the rising costs of health care.

The Mandate to the Rescue

After discussing dramatically rising healthcare costs, what makes those costs so high, and how those costs affect American citizens, it is obvious that many problems exist. In a hopeful effort to lower healthcare costs and to provide coverage for all Americans, Obama and his administration have enacted the individual mandate which will be enforced in 2014. This mandate requires all American citizens to be insured by the first of the year or penalizes those who are not insured. A detailed explanation as to how the mandate will fix the costs is longed for and even expected in such a report as this. However, that kind of answer is impossible at this time due to lacking results. Hopes, opinions, and predictions are offered, but certainty is unknown and could be unknown for years to come. This being said, a look at certain expectations will prove to be helpful and possibly encouraging.

According to most recent studies, the lowered premiums are supposed to save the federal government $190 billion in 10 years. Doing the math, the savings can be envisioned. If the country spends an average of 2.6 trillion on health care each year, and $190 billion will be saved in the next decade, 13.6 billion will still be spent on healthcare each year. Though these savings might positively affect the government in the long run, currently individuals signing up for Obamacare are not saving, but losing money. Their premiums are skyrocketing and their coverage is changing dramatically(Walsh).

Costs within the government may not exactly be lessening either. With the mandate being enacted, about 16 million people will have new coverage. 6 to 7 million of these individuals will be receiving their insurance from Medicaid. Due to this action, those 6 million individuals will begin using $10 to $12.5 billion in uncompensated care from Medicaid. It is believed that if those individuals had remained without insurance funded by Medicaid, they would only be costing the system about $4 billion in uncompensated care(Forbes). In this sense, costs are not lessening, only shifting elsewhere.

This discussion could continue for hundreds of pages in comparing opinions and predictions of supporters and critics. “Supporters say the changes are holding down costs and increasing doctors’ and hospitals’ focus on keeping patients healthy. But critics say the law is likely having little effect on medical costs, and they accuse the federal government of meddling in the way healthcare is delivered”(CQ Researcher). To be blatantly objective and honest, the results simply are unavailable. The health of the country, the economy of the country, and various other factors cannot be determined at this point.

Necessary Virtues for the Future

This report leaves our figure from the beginning of the paper in a predicament. What Katie and her family have to rely on are only predictions and hopes for the future of our country’s healthcare system. Although a purpose of the individual mandate is to lower the health care costs for families like Katie’s, the costs could rise or lower depending on many factors. Katie and her husband must have patience, intelligence, and unity along with the rest of America as they proceed down this unknown path towards hopeful progress for their family and country.

Works Cited

Walsh, Matt. “The Definitive Guide to How Obamacare is Destroying American Lives”. The Matt Walsh Blog. Web. 21 Oct. 2013.

“Health Care Costs, A Primer”. The Henry J. Kaiser Family Foundation. KFF. n.p. Web. May 2012.

Congressional Budget Office(CBO). Expanding Health Insurance Coverage and Controlling Costs for Health Care. Web. n.p. 10 Feb. 2009

“Health Care Costs, A Primer”. The Henry J. Kaiser Family Foundation. KFF. n.p. 25. Web. May 2012.

“Reducing Waste in Health Care”. Health Affairs. Health Affairs. n.p. Web. 13 Dec. 2012

“The Facts About Rising Healthcare Costs”. Aetna. Aetna. Web n.p.

Pipes, Sally. “ObamaCare's Individual Mandate Will Raise, Not Lower Costs”. Forbes. Forbes, 2012. Web. 20 Apr. 2012

“Health Care”. CQ Researcher. n. pag. CQ Press Web. 15 June. 2013